Commercial health care spending is estimated to grow to its highest level in 14 years, according to Price Water House Cooper’s (PWC) research into annual medical cost trends. PwC’s Health Research Institute is projecting an 8% year-on-year medical cost trend in 2025 for the group market and 7.5% for the Individual market. This near-record trend is driven by inflationary pressure, prescription drug spending and behavioral health utilization.

Medical care costs are increasing at a far greater pace annually than the average annual pay increase (note: federal employees are expected to receive an average 1 percent pay increase for 2026 while CSRS annuitants will receive a 2.8 percent COLA and FERS annuitants a 2.0 COLA effective January 1. 2026). Federal employees and annuitants have an opportunity to save money in a tax-advantaged manner in order to pay current and future medical expenses by utilizing health savings accounts (HSAs). But to reduce the cost of medical care using HSAs, it is imperative that employees and annuitants have a full understanding of HSA rules. This column discusses HSA rules including eligibility rules and the types of medical expenses that can be paid tax-free from an HSA.

SEE ALSO:

- IRS Announces Increase in Health Savings Account (HSA) Contribution Limits for 2026

- How Medicare Affects Those With Health Savings Accounts in Retirement

HSAs combine the tax deductible and tax-free features of traditional IRAs and Roth IRAs respectively when it comes to paying medical, dental and vision expenses. Contributions to HSAs are made with before-taxed dollars and distributions from HSAs are tax-exempt if used to pay for qualifying medical, dental and vision expenses. Also, unlike a Health Care Flexible Spending Account (HCFSA), HSA funds do not have to be entirely spent within the plan year and before an employee leaves or retires from federal service. Unused HSA funds can be carried over from year-to-year and into retirement and used to pay medical expenses in retirement. Withdrawals from an HSA to pay qualified medical expenses are federal and in most states state income-tax free.

An HSA owner can make deductible contributions (as an adjustment to income on one’s federal income tax return) to an HSA. An HSA is administered by a bank, brokerage, credit union or insurance company. The HSA can be invested in stocks, bonds, mutual funds, ETF’s and similar investments. Earnings grow tax-free provided when they are withdrawn, they are used to pay for qualified medical, dental and vision expenses. federal and state income taxes must be paid if the amount withdrawn is not used to pay for qualified medical, dental and vision expenses. If the HSA owner is younger than age 65 and makes HSA withdrawals in order to pay non-medical expenses, then in addition to federal and state income taxes a 20 percent early withdrawal penalty must be paid.

HSA Eligibility Rules

In order to contribute to an HSA, an individual must fulfill several requirements. They are:

· The individual must be covered by a high deductible health insurance plan (HDHP). The IRS every year declares the minimum high deductible amount for the three categories of health insurance coverage. For “self only “coverage during 2026, the HDHP must have an annual deductible of at least $1,700 and annual out-of-pocket expenses (for example, deductibles, co-payments and coinsurance) cannot exceed $8,500. For family coverage (includes “self plus one” and “self and family” coverages), the HDHP during 2026 must have an annual deductible of at least $3,400. Annual out-of-pocket expense during 2026 for “self plus one” and “self and family” coverages cannot exceed $17,000. Except for preventive care, the HDHP will not pay or reimburse for qualified medical expenses until the HSA owner and the HSA owner’s family has incurred annual covered medical expenses in excess of the annual deductible. Federal employees who want to contribute to an HSA have to be enrolled in an FEHB program sponsored HDHP. If they are not currently enrolled in an HDHP, then they will have to enroll in an HDHP during the current FEHB program “open season” (November 10,2025 through December 8,2025).

· The individual may not be covered by any other health insurance plan that is not an HDHP health insurance plan. This other health insurance plan includes an individual’s secondary health insurance, a spouse’s health plan that is not an HDHP, or any part of Medicare (Parts A, B, C or D). The individual may still be covered under workers’ compensation laws, enrolled in insurance for the individual’s auto, home insurance, dental insurance, vision insurance, long-term care insurance or disability income insurance.

· The individual may not be claimed as dependent on someone else’s tax return. With the passage of the Tax Cuts and Jobs Act of 2017 (TCJA), this requirement may be difficult to understand. This is because under TCJA (and continuing with the One Big Beautiful Bill Act of 2025 or OBBBA), there is no dollar exemption deduction for tax dependents. TCJA set the dependent exemption amount to $0 for tax years 2018 through 2025 and continuing for at least the next 5 to 10 years under the OBBBA. But TCJA and OBBBA did not eliminate the rules of “tax dependents” with respect to eligibility to utilizing tax deductions and tax credits and that includes HSA ownership. This means that if an individual is claimed as a tax dependent on another person’s tax return, that individual is not eligible to own his or her HSA.

Note that the Affordable Care Act (ACA) allows adult children up to the age of 26 to be included on their parents’ health insurance plans, regardless of whether the child is claimed as a tax dependent on the parents’ tax return or if the child claims the dependent exemption for himself or herself. For an adult child’s medical expenses to qualify for disbursement from the parent’s HSA, the adult child must qualify as a tax dependent. This means that although an adult child may be included on the parent’s FEHB program health insurance plan, funds cannot be withdrawn from the parent’s HSA to pay that child’s medical expenses unless the child qualifies as a tax dependent child. The following example illustrates:

Wendy is a federal employee and enrolled in a FEHB program HDHP and contributes to the HSA that is associated with her HDHP. Wendy is divorced and has one child, Phillip (age 23) who is also a federal employee. To save premium dollars, Wendy has self plus one coverage with Phillip on her FEHB program HDHP. Since Phillip earns too much, he does not qualify as a tax dependent. This means that Wendy’s HSA cannot be used to pay for Phillip’s out-of-pocket medical expenses. Phillip is advised to enroll in an HDHP and have his own HSA in order to pay his out-of-pocket medical expenses in a tax-beneficial way.

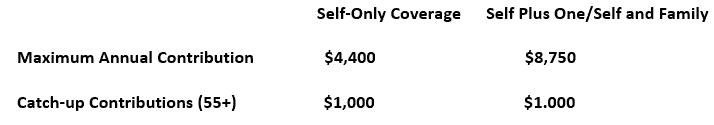

HSA Contribution Limits for 2026

The following are HSA contribution limits for 2026:

An HDHP has: (1) A higher annual deductible than fee-for-service and preferred provider organization plans; and (2) An annual limit on the amount of out-of-pocket medical expenses that the insured must pay for covered expenses. Out-of-pocket expenses include copayments, coinsurance, deductibles and medical expenses not covered by the HDHP. This does not include the HDHP insurance premiums.

An HDHP will provide “preventive care” benefits without its deductible having to be met (called “first dollar” coverage). Preventive care includes but is not limited to the following types of medical procedures:

1. Periodic health evaluations, including tests and diagnostic procedures ordered in connection with routine examinations, such as annual physicals

2. Routine prenatal- and well- childcare

3. Child and adult immunizations.

4. Tobacco cessation programs

5. Obesity weight-loss programs

6. Screening services. This includes screening services for the following:

a. Cancer

b. Heart and vascular diseases

c. Infectious diseases

d. Mental health conditions

e. Substance abuse

f. Metabolic, nutritional and endocrine care

g. Musculoskeletal disorders

h. Obstetric and gynecological care

i. Pediatric care

j. Vision and hearing disorders

A federal employee covered by an HDHP and who is also enrolled in a healthcare flexible spending account (HCFSA) (offered through the “FedFlex” program) is not allowed to make contributions to their HSA. However, a federal employee who owns an HSA while enrolled in an HDHP is permitted to be enrolled in a “limited expense” health care FSA (“LEXHCFSA”) that reimburses only for out-of-pocket dental and vision expenses.

It is important to emphasize that an individual who has a funded HSA can always make withdrawals from the HSA to pay for qualified medical expenses. However, whether the individual can contribute to the HSA in a particular year depends on the three factors discussed above: (1) Covered by an HDHP; (2) Not have any other health insurance coverage that is not a HDHP; and (3) Not claimed as a tax dependent by another individual.

Qualified medical expenses that can be paid using HSA withdrawals are those medical expenses that would be deductible for federal income tax purposes on Schedule A as an itemized deduction (“medical and dental” expenses). This includes amounts paid for: (1) Copayments and co-insurance; (2) Deductibles; (3) Diagnostic services; (4) Long-term care insurance premiums; (5) LASIK surgery; (6) Nursing services; (7) Medicines and drugs if they require a prescription; and (8) Insulin (with or without a prescription). HSA withdrawals can also be used to reimburse a Medicare beneficiary the monthly premiums for Medicare Part B and Medicare Part D.

Coordination with Medicare Enrollment

Before HSAs became available in 2003, financial professionals recommended individuals who were not collecting Social Security at age 65 to enroll in Medicare Part A (Hospital Insurance) regardless of other health insurance coverage. By being enrolled in Medicare Part A, the individual was more likely to avoid penalties for late enrollment in Medicare Part B (Medical Insurance) and Medicare Part D (Prescription Drug coverage) if the individual continued working with an employer providing group health insurance (such as a federal employee enrolled in the FEHB program).

This recommendation still applies, but an exception is for any individual working past age 65, enrolled in an HDHP with access to an HSA, and who wants to continue contributing to their HSA. In particular, any HSA owner who works past age 65 cannot contribute to their HSA if the individual enrolls in Medicare. The following is a brief summary of the Medicare enrollment rules for federal employees who are HSA owners and who want to continue contributing to their HSAs:

1. Those federal employees who are not yet collecting Social Security and reached their 65th birthday and still working in federal service while enrolled in an FEHB program HDHP in which they are contributing to an HSA, should defer signing up for Medicare at their 65th birthday in order to continue contributing to their HSAs.

2. Federal employees who continue to work in federal service and enrolled in the FEHB program when they reach age 65 can enroll in Medicare immediately after they retire from service and not be subject to any late enrollment penalty for Medicare Part B. They must do so during their Special Enrollment Period (SEP). The SEP is an eight-month period starting the first of the month after the month the employee retires and concludes at the end of the eighth month thereafter.

3. HSA contributions are disallowed when Medicare Part A is in place. However, a federal employee or retiree who owns an HSA associated with an FEHB program HDHP can make withdrawals from HSA funds already in the HSA to pay for qualified medical expenses. But the employee or retiree cannot contribute to their HSA once they enroll in Medicare Part A. In fact, the employee or retiree should stop contributing to their HSA the month before they intend to enroll in Medicare Part A when they become age 65 (during their Initial Enrollment Period).

Edward A. Zurndorfer is a CERTIFIED FINANCIAL PLANNER®, Chartered Life Underwriter, Chartered Financial Consultant, Registered Health Underwriter and Enrolled Agent in Silver Spring, MD. Tax planning, Federal employee benefits, retirement and insurance consulting services offered through EZ Accounting and Financial Services, located at 833 Bromley Street Suite A, Silver Spring, MD 20902-3019

Edward A. Zurndorfer is a CERTIFIED FINANCIAL PLANNER®, Chartered Life Underwriter, Chartered Financial Consultant, Registered Health Underwriter and Enrolled Agent in Silver Spring, MD. Tax planning, Federal employee benefits, retirement and insurance consulting services offered through EZ Accounting and Financial Services, located at 833 Bromley Street Suite A, Silver Spring, MD 20902-3019