Recent floods from hurricanes and destruction from wildfires have taught many of homeowners one thing: They most probably have inadequate homeowner’s insurance more…

Oct. 15 Deadline: Reversing Roth IRA Conversions and Filing Income Tax Returns for 2017

Federal benefits expert, Ed Zurndorfer, provides tips for individuals recharacterizing 2017 Roth IRA conversions and those who required extensions for filing their 2017 income tax returns more…

4 Rules Federal Employees Should Know About Roth IRA Conversions

Federal benefits expert, Ed Zurndorfer, outlines some important cautions — and tax consequences — for those considering a conversion of their traditional IRAs to Roth IRAs more…

Individual Retirement Arrangement (IRA) Planning Strategies for 2018

Tax law changes during 2018 that are affecting Individual Retirement Arrangement (IRA) planning strategies this year. Federal benefits expert, Ed Zurndorfer, reviews five of these strategies. more…

Federal Employees Should Explore Alternatives for Paying Future Long-Term Care Expenses (Part II)

Soaring premiums for stand-alone LTC policies in recent years have caused individuals to seek options. Federal benefits expert, Ed Zurndorfer, discusses combined life insurance and long-term care insurance policies — and the pros and cons of this alternative more…

Federal Employees Should Explore Alternatives for Paying Future Long-Term Care Expenses (Part I)

Today’s and future retirees face extended life expectancies and rising costs for nursing home stays, assisted living facilities and home health care. Federal benefits expert Ed Zurndorfer discusses the alternatives for stand-alone LTC insurance policies — including a combination fixed annuity with payouts for long-term expenses more…

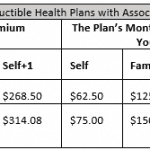

How Health Savings Accounts (HSAs) Can Reduce the Cost of Medical Care (Part II)

Federal benefit expert, Ed Zurndorfer, discusses how HSAs are a great way for federal employees and retirees to get tax deductions for medical expenses — including long term care expenses and Medicare Part B premiums more…

How Health Savings Accounts (HSAs) Can Reduce the Cost of Medical Care (Part I)

To reduce the cost of medical care using HSAs, it is imperative that federal employees and retirees fully understand the rules. Federal benefits expert Ed Zurndorfer discusses HSA eligibility and what types of medical expenses can be paid from an HSA more…

How the Thrift Savings Plan Is Taxed

Federal benefits expert Ed Zurndorfer discusses how the method a TSP account owner withdraws their account balance determines when federal and state income taxes are levied more…

How CSRS and FERS Annuities Are Taxed Under the Alternative Annuity (Lump Sum) Option

Federal benefits expert Ed Zurndorfer discusses the federal income tax liability a retiring federal employee has if they choose a lump sum alternative form of a CSRS or FERS annuity. more…