Each year when individuals prepare their federal income tax returns, they must choose a filing status that accurately matches their circumstances. An individual’s filing status may change after a major life event such as getting married, getting divorced or moving to a different state or country.

An individual’s filing status can affect their federal tax liability in the following ways:

(1) Whether the individual must file a tax return;

(2) How much tax the individual owes;

(3) The tax credits the individual can claim;

(4) The type of tax form the individual should file;

(5) The amount of the individual’s standard deduction; and

(6) Whether the individual will get a tax refund or has a balance due.

For the purpose of filing an individual’s federal income tax return, there are five filing statuses, namely: (1) Single; (2) Married filing jointly; (3) Married filing separately; (4) Head of household; and (5) Qualifying surviving spouse. One’s filing status is based on an individual’s marital status on the last day of the year. Each of the five filing statuses is discussed.

Single Filing Status for 2025

An individual files as single for 2025 if the individual was unmarried or separated from a spouse (either by divorce or a separate maintenance decree) as of December 31, 2025. A widow(er) whose spouse died before January 1,2025 is single unless they meet the tests for qualifying surviving spouse (see below).

Married Filing Jointly for 2025

Individuals may file jointly for 2025 if, as of December 31, 2025, they are: (1) Married and living together; (2) Married and living apart but not legally separated or divorced; (3) Separated under an interlocutory (not final) divorce decree; or (4) Living in a common-law marriage, if common-law marriage is recognized in the state of residence they live or in the state where they were married.

Note that if one spouse died during 2025, then the surviving spouse is eligible to file jointly with the deceased spouse if the couple met one of the four tests mentioned above, and the surviving spouse did not remarry during 2025. For federal law purposes, the term spouse also includes an individual married to another person of the same sex, as long as the couple is legally married.

Married Filing Separately for 2025

Individuals who are married as of December 31,2025 can elect to file married filing separately. Two reasons that married couples may file separately are:

1. No joint tax liability. Each spouse who signs a joint return is responsible for the accuracy of the return as well as payment of the tax owed. A spouse who files separately is not responsible for reporting or paying tax on income items attributable to the other spouse; and

2. Some couples pay less tax filing separately. Spouses with equal incomes will generally owe the same tax under either filing status. This is the case unless one spouse has significantly high medical expenses or casualty losses that are subject to a percentage limitation based on adjusted gross income (AGI). If one spouse has significantly higher income than the other spouse, then the couple will generally pay less tax filing married filing jointly.

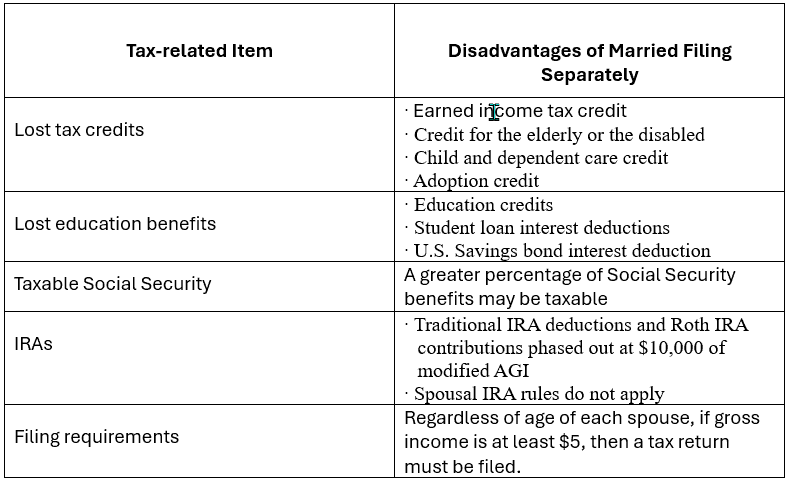

There are definite disadvantages to filing married separately, as shown in the following table:

Head of Household Filing Status for 2025

To qualify for the head of household (HH) filing status for 2025, an individual must be either unmarried or considered unmarried as of December 31, 2025. An individual is considered unmarried as of December 31, 2025 if he or she meets all four of the following requirements: (1) Files a separate tax return (includes filing as married filing separate, single or head of household); (2) Paid more than half the cost of keeping up a home for the tax year; (3) The individual’s spouse did not live in the individual’s home during the last six months of 2025; (4) Home was the main residence of a qualifying person or a qualifying child which includes a son, daughter, stepchild, or grandchild), for more than half the year. If the qualifying person is the individual’s dependent parent, then the parent does not have to live with the individual. For a child, the individual must be able to claim the child as a dependent.

A married individual is considered unmarried for HH purposes if the individual’s spouse was a nonresident alien at any time during 2025 and the individual did not choose to treat the nonresident alien as a resident alien. But the individual’s spouse is not a qualifying person for HH purposes. The individual must have another qualifying person and meet other tests to be eligible to file as HH. The individual is also considered married if they choose to treat their spouse as a resident alien.

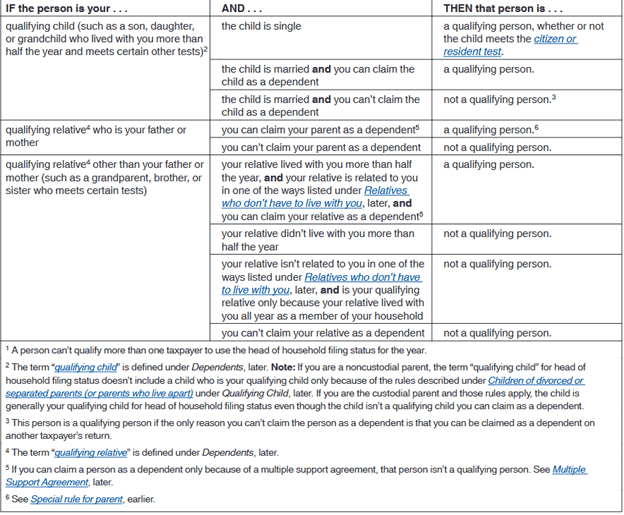

The following table from IRS Publication 501 (Dependents, Standard Deduction and Filing Information) summarizes the qualifying person rules for the purpose of claiming HH filing status.

Who Is a Qualifying Person Qualifying You to File as Head of Household?

The following examples illustrate who is a qualifying person for the purpose of claiming HH filing status:

Example 1. Margaret’s unmarried son lived with her throughout 2025. He did not provide more than half of his own support and did not meet the tests to be a qualifying child of anyone else. As a result, he is Margaret’s qualifying child and since he is single, he is Margaret’s qualifying person for HH purposes.

Example 2. Harold’s unmarried daughter lived with Harold throughout 2025. Her gross income during 2025 was $6,000. Since she does not meet the age test, Harold’s daughter is not Harold’s qualifying child. Also, since she does not meet the gross income test, she is also not Harold’s qualifying relative. As a result, she is not Harold’s qualifying person for HH filing purposes during 2025.

Example 3. Frank’s girlfriend lived with Frank throughout 2025. Even though she may be Frank’s qualifying relative if the gross income and support tests are met, she is not Frank’s qualifying person for HH purposes during 2025 because she is not related to Frank in one of the ways listed under “relatives who do not have to live with the individual”.

The following are some other considerations that affect HH filing status during 2025:

1. Temporary absences. An individual and his or her qualifying person is considered to live together even if one of them is temporarily absent from the home due to special circumstances such as illness, vacation, military service, or detention in a juvenile facility. It must be reasonable to assume the absent person will return home after the temporary absence. The individual must continue to keep up the home during the absence.

2. Parents. In general, the qualifying person must live with the individual for more than half of the year. If the individual’s qualifying person is the individual’s father or mother, then the individual may be eligible to file as HH during 2025 even if his or her parent(s) does not live with the individual. But the individual must be able to claim his or her parent(s) as a dependent.

3. Dependent birth or death. The individual may be eligible to file as HH even if the qualifying person who qualifies the individual for HH during 2025 is born or dies during 2025. To qualify the individual for HH filing status during 2025, the qualifying person must be one of the following:

a. Individual’s qualifying child or qualifying relative who lived with the individual for more than half the year he or she was alive.

b. Individual parent for whom the individual paid for the entire part of 2025 that the parent was alive, more than half the cost of keeping up the home the parent lived in.

Qualifying Surviving Spouse Filing Spouse for 2025

For an individual to file as a qualifying surviving spouse for 2025, all of the following tests must be met: (1) The individual’s spouse died in 2023 or 2024; (2) The individual was entitled to file a joint return for the year the spouse died; (3) The individual did not remarry before January 1, 2026; (4) The individual paid more than half the cost of keeping up their home; and (5) The individual’s home was the main home for all of 2025 of the individual’s dependent child or stepchild, but does not include a foster child.

Edward A. Zurndorfer is a CERTIFIED FINANCIAL PLANNER®, Chartered Life Underwriter, Chartered Financial Consultant, Registered Health Underwriter and Enrolled Agent in Silver Spring, MD. Tax planning, Federal employee benefits, retirement and insurance consulting services offered through EZ Accounting and Financial Services, located at 833 Bromley Street Suite A, Silver Spring, MD 20902-3019

Edward A. Zurndorfer is a CERTIFIED FINANCIAL PLANNER®, Chartered Life Underwriter, Chartered Financial Consultant, Registered Health Underwriter and Enrolled Agent in Silver Spring, MD. Tax planning, Federal employee benefits, retirement and insurance consulting services offered through EZ Accounting and Financial Services, located at 833 Bromley Street Suite A, Silver Spring, MD 20902-3019