All federal employees – those covered by the Civil Service Retirement System (CSRS and CSRS Offset employees), the Federal Employees Retirement System (FERS) or a combination of CSRS and FERS – “Trans” FERS employees) – upon retiring from federal service will receive either a CSRS annuity, a FERS annuity, or with some employees (“Trans” FERS employees) a combination of both annuities. The annuities are computed by OPM’s Retirement Processing office on behalf of retiring federal employees.

To calculate the annuity, OPM needs to determine the retiring employee’s:

(1) Length of service and

(2) High-three average salary.

In spite of legislation before Congress over the last 30 years to change the high-three average salary to the high-five average salary, noting has been passed into law.

This column explains what the high-three average salary is, what it is composed of, and how it is computed.

What is the High-3 Average Salary?

The high-three average salary is defined as a retiring employee’s highest basic pay averaged over any three consecutive years in federal service. For retiring federal employees who most often earn their highest salaries at the end of their service with the federal government, this three-year period is the three-year period ending on the year, month and day the employee retires. However, pay from an earlier three-year consecutive period may have been higher.

The pay/salary that OPM uses in the computation of the high-three average salary is the pay/salary for which CSRS or FERS retirement contributions are deducted.

For CSRS employees. These contributions are equal to 7 percent of an employee’s salary each pay period and contributed to the CSRS Retirement and Disability Fund.

For most FERS employees, the contributions are equal to 0.8 percent of an employee’s salary deducted each pay-period and contributed to the FERS Retirement and Disability Fund.

Types of Pay Included in High-Three Average Salary

For employees who are in the General Schedule (GS) pay system, the following types of pay are included with respect to calculations of the high-three average salary:

(1) Regular pay;

(2) locality-based pay;

(3) environmental differential pay:

(4) premium pay for standby pay;

(5) law enforcement availability pay;

(6) nigh differential pay for Federal Wage System (Blue-Collar) employees only; and

(7) special pay rate for recruiting and retention purposes.

Types of Pay Not Included in High-Three Average Salary

The following types of pay are not included in the calculation of the high-three average salary:

(1) Lump-sum payment for accrued and accumulated annual leave;

(2) bonuses and overtime, holiday pay, Sunday premium pay and military pay;

(3) General Schedule (GS) night differential pay and foreign or non-foreign post differential pay;

(4) travel allowances; and

(5) recruiting or retention bonuses.

How to Determine the Beginning Date of Three Year Period

To determine the beginning day of the three-year period used in the calculation of the high-three average period, it is important to mention two points with respect to the Office of Personnel Management (OPM’s) calendar and an employee’s retirement date:

Step 1: OPM uses a 30-day per month for every month of the year, or 360 days per year

Step 2: If a retiring employee’s retirement day is any day of the month other than the last day of the month, add one to the day of the month. If the employee retires on the last day of any month, use that day.

Step 3: Subtract 3 years, 0 months and 0 days from the retirement date (year-month-day) in (2) in order to determine the beginning day of the three-year period.

The following two examples will illustrate:

Example 1: Jerry, a CSRS-covered employee retired from federal service with 40 years of service on January 1, 2022. The beginning date of Jerry’s three-year period used in the calculation of his high-three average salary is determined using the following table:

Example 2. Delores, a FERS-covered employee, retired from federal service with 30 years of service on December 31, 2021. The beginning date of Delores’ three-year period used in the calculation of her high-three average period is presented here in the following table:

An exception to using a retiring employee’s salaries coinciding with the last three years of federal service occurs when the employee had higher pay rates during a prior three-year service period. In that case, the prior three-year period of service should be used. The following example illustrates:

Example 3. Same facts as in Example 1 except that Jerry actually earned his highest three years of salary between 2017 and 2020, about a year before he retired.

In that case, Jerry’s high-average period will cover the period from January 2,2018 through January 1, 2021.

The three years of service used in the computation of the high-three average need not be continuous but must be consecutive. Two or more separate periods of employment may be combined provided there is no intervening service. Consider the following in which a retiring employee was earning his or her highest salary during the last two years of federal service but had breaks of service.

How to Calculate Your High 3 Average Salary

To calculate the high-three average salary, the periods 6-22-2007 to 6-21-2008 and 11-15-2016 to 11-14-2018 are used to equal three years, zero months and zero days of service.

The following procedure is used to calculate the high-three average salary:

Step 1: Determine the beginning date and the ending date of the high-three average period.

Step 2. Use the Time Factor chart (360-day factor chart available from OPM’s CSRS and FERS retirement handbook (reproduced below) to determine the fraction of a year (360 days) that the period covers.

Step 3. Enter the annual rate of pay (SF-50 salary) for the total basic pay.

Step 4. Multiply the time factors by the annual rate (SF-50 salary) for the Total Basic Pay during the period.

Step 5. Add the entries in the Total Basic Pay column.

Step 6. Divide the sum of the Total Basic Pay for the three-year period by the number 3 in order to determine the high-three average salary.

In conjunction with these steps, the following chart is used to compute the high-three average salary:

30-Day Month Factor Table

Factors for computing total amount for any period of time at given annual rate. (30-day month. To complete factor place number of full years ahead of decimal point).

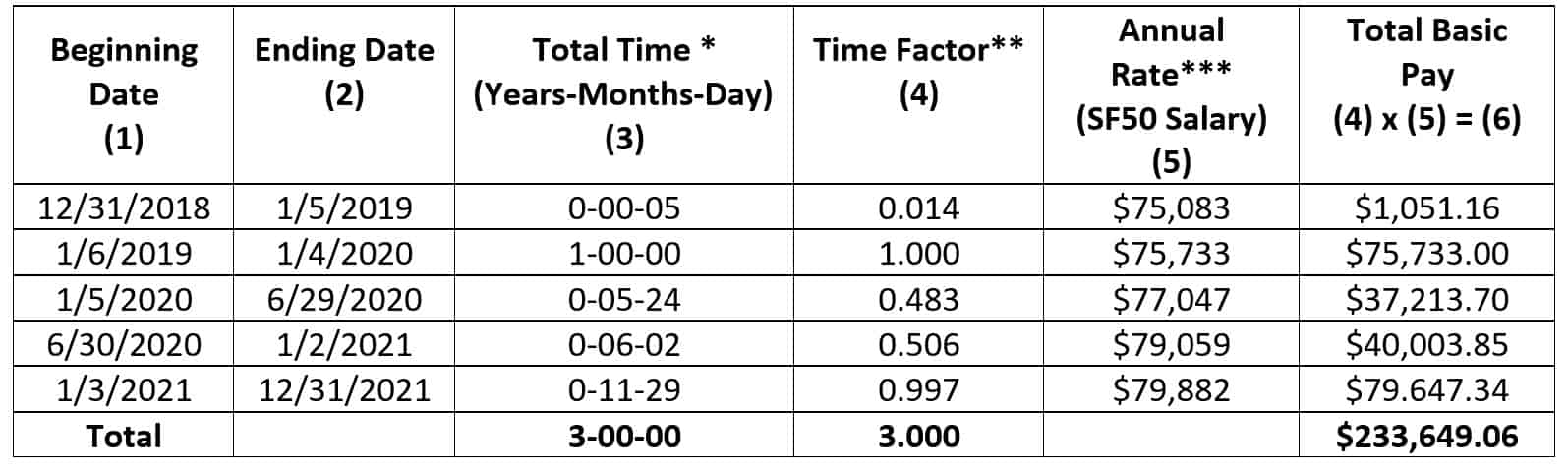

The following example illustrates: Returning to Example 2 above (Delores). Delores retired from federal service on Dec. 31, 2021 and was earning her highest salaries during the last three years of her federal service. The table below is used to compute Delores’ high-three average salary.

Delores’ high-three average salary is therefore computed as the sum of the Total Basic Pay (column 6) divided by 3, or:

$233,649/3 equals $77,883.02

It is important for employees to understand that the longer an employee is at a high pay scale, the more effect (weight) it has on the employee’s high-three average salary. Retiring employees should therefore understand that postponing one’ retirement for a soon-to-be salary increase (for example, government-wide pay increase) will have a negligible effect on the retiring employee’s high-three average salary if the employee postpones his or her retirement and works no less than three months at the higher salary.

In the case of Delores who retired on Dec. 31, 2021, decided to postpone her retirement in order to include the government-wide pay increase for federal employees that took effect on Jan. 2, 2022, then she would have to postpone her retirement date at least until the end of March 2022 in order to have the government-wide pay increase of 2.7 percent taking effect on Jan. 2, 2022.

Edward A. Zurndorfer is a CERTIFIED FINANCIAL PLANNER®, Chartered Life Underwriter, Chartered Financial Consultant, Registered Health Underwriter and Enrolled Agent in Silver Spring, MD. Tax planning, Federal employee benefits, retirement and insurance consulting services offered through EZ Accounting and Financial Services, located at 833 Bromley Street Suite A, Silver Spring, MD 20902-3019

Edward A. Zurndorfer is a CERTIFIED FINANCIAL PLANNER®, Chartered Life Underwriter, Chartered Financial Consultant, Registered Health Underwriter and Enrolled Agent in Silver Spring, MD. Tax planning, Federal employee benefits, retirement and insurance consulting services offered through EZ Accounting and Financial Services, located at 833 Bromley Street Suite A, Silver Spring, MD 20902-3019