Federal benefits expert, Ed Zurndorfer, discusses health care flexible spending accounts and how HCFSAs can benefit all federal employees, including those employees not enrolled in the Federal Employees Health Benefits program more…

How to Submit a Healthy Federal Retirement Application Package

Learn how — after making sure all documents, forms and information are complete — a retiring federal employee will be submitting a “healthy” federal retirement package under OPM’s guidelines, thereby avoiding unnecessary delays in processing of their retirement application package more…

Federal Public Safety Employees Can Make Penalty-Free TSP Withdrawals Starting at Age 50

The Defending Public Safety Employees Retirement Act of 2015 amended the Internal Revenue Code to allow specified federal law enforcement officers, customs and border protection officers, federal firefighters and air traffic controllers who separate from service during or after the year they become age 50 to make withdrawals from the TSP without incurring a 10 percent early withdrawal penalty. Federal benefits expert, Ed Zurndorfer, discusses what the new law means to federal employees who are eligible to take advantage of the new law more…

Will New Voluntary FEHB Option Be Helpful to Federal Annuitants Eligible for Medicare?

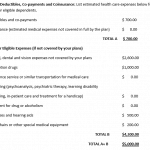

While the National Association of Active and Retired Federal Employees (NARFE) stated this option would save money for federal retirees, federal benefits and tax expert, Ed Zurndorfer, provides insight why it will most likely significantly increase the overall health care costs to the average federal annuitant enrolled in Medicare in the form of higher deductibles, co-payments and co-insurance more…

Federal Employees 50 and Older Are Encouraged to Make TSP “Catch-Up” Contributions

“Catch-up” contributions are supplemental tax deductible contributions that CSRS and FERS employees age 50 and older can make to the Thrift Savings Plan. Federal benefits expert, Ed Zurndorfer, gives insight on how they work and how they can benefit the employee more…

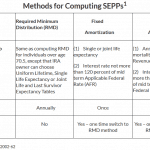

Voluntary Contribution Program (VCP): Withdrawal Options for CSRS and CSRS-Offset Employees

Federal benefits expert, Edward Zurndorfer, provides insight on the three withdrawal methods for VCP participants, including a rollover to a Roth IRA and annuity options that allow a CSRS or CSRS Offset employee the option to receive an additional CSRS annuity from the Office of Personnel Management. Practical examples are included more…