Federal benefits and tax expert, Ed Zurndorfer, provides a list of the proposed major changes plus some year-end planning suggestions for federal employees and retirees more…

How Federal Employees Can Reduce Out-of-Pocket Costs With Health Savings Accounts

Federal benefits expert describes why employees and retirees should focus on both plan premium increases and out-of-pocket increases before choosing a health insurance plan — and why an HSA is one of the best ways to pay for health, dental and vision expenses more…

How Federal Employees Can Save Tax Dollars on Health, Dental and Vision Premiums

Federal benefits expert, Ed Zurndorfer, discusses tax savings through “premium conversion” — and when federal employees may want to waive it more…

How Would a High-Five Average Salary Affect Future Federal Retirees?

Federal benefits expert, Ed Zurndorfer, discusses how much will the average retiring federal employee lose if a high-five average salary is adopted for purposes of calculating a CSRS or FERS annuity more…

Should FERS Employees Depend on the Special Retirement Supplement To Determine When to Retire?

Under recent budget proposals, the FERS supplement could be eliminated sometime in the future. Federal benefits expert, Ed Zurndorfer, discusses the effect of eliminating the SRS annuity will have on FERS employees, whether or not they should include the supplement as one of the determining factors for retiring more…

10 Mid-Year Tax Saving Moves for Federal Employees

Personal and financial events can have a big impact on one’s annual tax bill. Federal benefits expert, Ed Zurndorfer, presents 10 tax saving ideas federal employees should consider more…

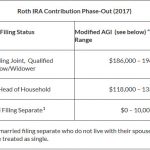

Federal Employees Ineligible to Contribute to a Roth IRA Can Use a ‘Backdoor’ Strategy

Federal benefits expert, Ed Zurndorfer, discusses how individuals can indirectly contribute to a Roth IRA through a backdoor strategy — even when their modified adjusted gross income exceeds the IRS specified limits more…

Why Federal Employees Should Review the Status of Their Traditional IRAs

Federal benefits expert, Ed Zurndorfer,discusses why reviewing the status of one’s traditional IRAs is important for retirement planning purposes more…

Strategies to Avoid TSP Required Minimum Distributions and Minimize Medicare Part B Premiums

Federal benefits expert, Ed Zurndorfer, outlines ways federal annuitants can use traditional IRAs to avoid Thrift Savings Plan RMDs and reduce their Medicare Part B premium costs more…

How to Avoid Costly Mistakes with Inherited IRAs

Federal benefits expert, Ed Zurndorfer, describes how to avoid the most expensive mistakes with inherited IRAs (that once made, cannot be fixed.) Options for what to do with an inherited IRA are also discussed more…