Federal benefits and tax expert, Ed Zurndorder, discusses which deductions have been eliminated and limited and why the standard deduction may benefit more individuals more…

New Tax Law Presents Challenges for Preparing 2018 Income Tax Returns

Federal benefits and tax expert, Ed Zurndorfer, highlights 14 of the major changes tax payers will face when filing for federal income taxes under the new law more…

Top 10 Tax Deductions Eliminated or Limited for 2018

Federal benefits expert, Ed Zurndorfer, discusses the more popular provisions in effect for tax years 2018 through 2025 which became law as a result of the Tax Cuts and Jobs Act more…

Non-Spousal Beneficiaries Have Until Dec. 31 to Take RMDs from Inherited IRAs

Federal benefits expert, Ed Zurndorfer, discusses the RMD requirements for inherited IRA owners including when they must start, how the RMD is calculated, and the IRS penalty for not taking the RMD more…

Health Care Flexible Spending Account Offers Alternative to Health Savings Account

What is a Health Care Flexible Spending Account? How does it compare to a Health Savings Account? Or a Health Reimbursement Arrangement? Federal benefits expert, Ed Zurndorfer, clears up the confusion and discusses the benefits for federal employees more…

HSAs Offer Trifecta Tax Benefit: Contributions, Growth and Distributions

Federal benefits expert, Ed Zurndorfer, outlines how a Health Savings Account offers tax deductible contributions, tax-free growth, and tax-free distributions — and describes how to fund an HSA through a transfer from a traditional IRA more…

Why Federal Employees Should Consider High Deductible Health Plans During Open Season

Federal benefits expert, Ed Zurndorfer, outlines how HDHPs — associated with a Health Savings Account or Health Reimbursement Arrangement – can provide greater flexibility in the use of your health care dollars more…

Considerations in Choosing a Health Insurance Plan for 2019

Federal benefits expert, Ed Zurndorfer, discusses important factors that federal employees and retirees should consider in making their decision for FEHB health care coverage during 2019. more…

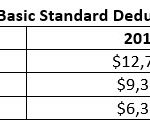

FEHB ‘Premium Conversion’ Becomes More Beneficial Under New Tax Law

Federal benefits expert, Ed Zurndorfer, explains what premium conversion is, how federal employees can save money using it, and why — under the new tax law — most will see even a greater benefit more…

Understanding FERS Disability Retirement – Part I

Federal benefits expert, Ed Zurndorfer, explains the complicated rules of qualifying and establishing eligibility for disability retirement for those covered by the Federal Employees Retirement System more…