Federal employees and retirees who after preparing their 2023 federal income tax return discover they have a large balance due to the fact that they are unable to pay in full before the April 15, 2024 deadline, have some options to their 2023 income tax balance due. There are some options including installment and online payment agreements with the IRS, and extensions of time to pay for those employees who are unable to pay the balance due on their 2023 federal income taxes.

This column discusses these options.

Installment Agreement

For an individual who owes taxes of $10,000 or less, Internal Revenue Code (IRC) Section 6159(c) requires that the IRS accept a proposed an installment agreement.

To qualify for an installment agreement, the individual must:

(1) Owe less than $10,000 in federal taxes;

(2) Agrees to fully pay the tax liability within three years;

(3) Has not entered into an installment agreement within the preceding five years;

(4) Has not failed to file an income tax return or pay any tax shown on such returns during any of the preceding five years; and

(5) Agrees to file and pay any taxes due during the term of the agreement. Note that the $10,000 dollar limitation applies to federal income taxes only. Penalties or interest charges are not counted in the $10,000 limitation.

Online Payment Agreement

An individual’s specific tax situation will determine which online payment options are available to him or her. Payment options include paying in full, requesting a short-term payment agreement (180 days or less) or a long-term payment agreement (paying in more than 180 days).

An individual may qualify to apply online if:

• Long-term agreement in which payments are made for more than 180 days. The amount owed is $50,000 or less in combined tax, penalties and interest, and all required tax returns (current and in past years) have been filed; or

• Short-term agreement in which payments are made for less than 180 days. The amount owed is less than $100,000 in combined tax, penalties and interest.

For both long-term and short-term online payment agreements, Interest continues to accrue until the balance is paid in full. The application for both long-term and short-term online payment agreements is available at https://www.irs.gov/payments/online-payment-agreement-application.

IRS Form 9465

Individuals who cannot or choose not to use the IRS Online Payment Agreement Application system can file Form 9465 (Installment Agreement Request) to request a monthly installment plan. If the amount owed is more than $50,000, Form 433-F (Collection Information Statement) must be attached. Form 9465 cannot be filed electronically.

If the total amount owed (taxes, penalties and interest) is greater than $25,000 but not more than $50,000, payments can be made by direct debit or by using payroll deduction. To use payroll deduction, Form 2159 (Payroll Deduction Agreement) must be submitted. A payroll deduction agreement is not available if Form 9465 is filed electronically.

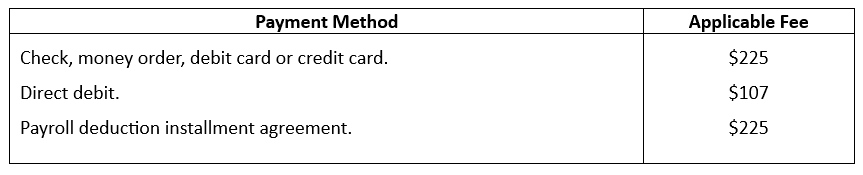

The following table summarizes the Form 9465 IRS user fees:

Interest and late payment penalties continue to apply during the installment period.

Extension of Time to Pay

An individual can request a six-month extension to file a 2023 income tax return by October 15,2024 and pay any balance due by the October 15,2024 filing deadline. To do so, an individual must submit IRS Form 1127 (Application for Extension of Time for Payment of Tax Due to Undue Hardship). The individual must show that he or she cannot sell any financial assets or borrow to pay the taxes due except under terms that would cause severe loss and undue hardship. A statement of net worth and a cash flow statement (disbursements made and cash assets received) covering a three-month period preceding the due date of the tax due must be submitted with Form 1127.

Form 1127 must be submitted to the IRS by the due date of the tax return. An approved extension via Form 1127 eliminates the late payment penalty but has no effect on interest charges on unpaid income tax balances.

Edward A. Zurndorfer is a CERTIFIED FINANCIAL PLANNER®, Chartered Life Underwriter, Chartered Financial Consultant, Registered Health Underwriter and Enrolled Agent in Silver Spring, MD. Tax planning, Federal employee benefits, retirement and insurance consulting services offered through EZ Accounting and Financial Services, located at 833 Bromley Street Suite A, Silver Spring, MD 20902-3019

Edward A. Zurndorfer is a CERTIFIED FINANCIAL PLANNER®, Chartered Life Underwriter, Chartered Financial Consultant, Registered Health Underwriter and Enrolled Agent in Silver Spring, MD. Tax planning, Federal employee benefits, retirement and insurance consulting services offered through EZ Accounting and Financial Services, located at 833 Bromley Street Suite A, Silver Spring, MD 20902-3019