With 65% of non-retired adults say their retirement savings aren’t on track, choosing a state to live in during retirement is an important financial decision.

“Retirement is supposed to be relaxing, but it can also be incredibly stressful given that it typically puts people on a fixed income, which may not be enough for them to live comfortably,” said Chip Lupo, an analyst at the personal finance website WalletHub. “As a result, the best states for retirees are those that have low taxes and a low cost of living to help retirees’ budgets stretch as far as possible. Having access to excellent medical care and homemaking services is also crucial, especially for people who don’t plan to retire in close proximity to their families.”

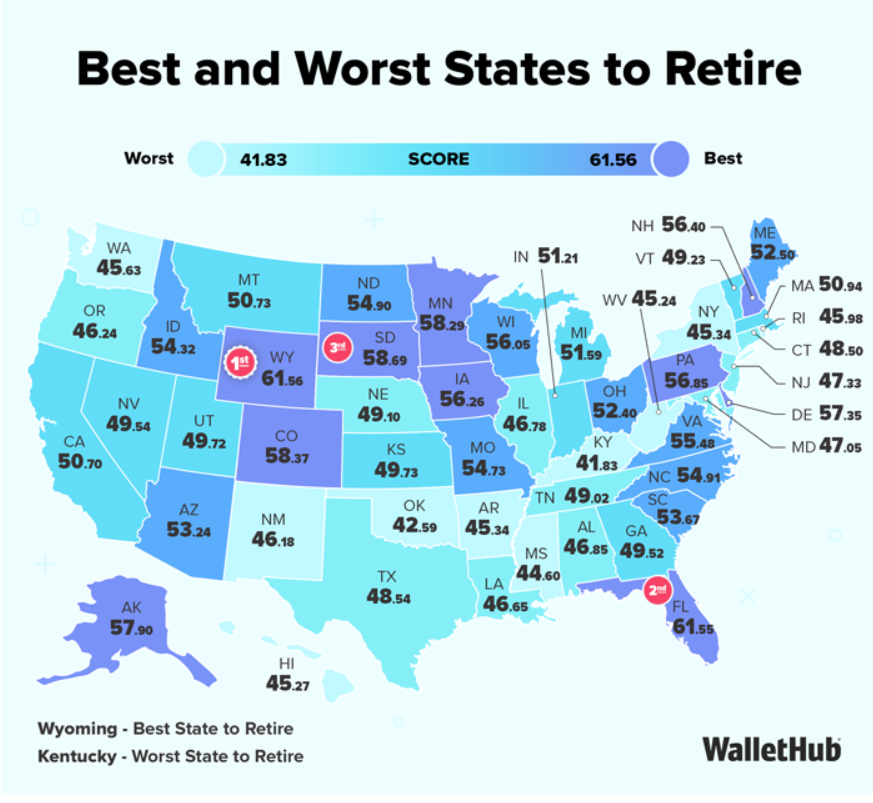

To determine the best (and worst) states to retire, the personal finance website, WalletHub, compared the 50 states across 46 key indicators of retirement-friendliness, including tax rates, cost of living and access to quality medical care and fun activities.

Wallethub’s latest study using these metrics found that the best states to retire (2026) are:

- Wyoming

- Florida

- South Dakota

- Colorado

- Minnesota

The worst states to retire (2026), according to the study are:

- Hawaii

- West Virginia

- Mississippi

- Oklahoma

- Kentucky

You can view WalletHub’s full rankings and commentary for all states in their study by going here.